Selling Cryptocurrency Taxes

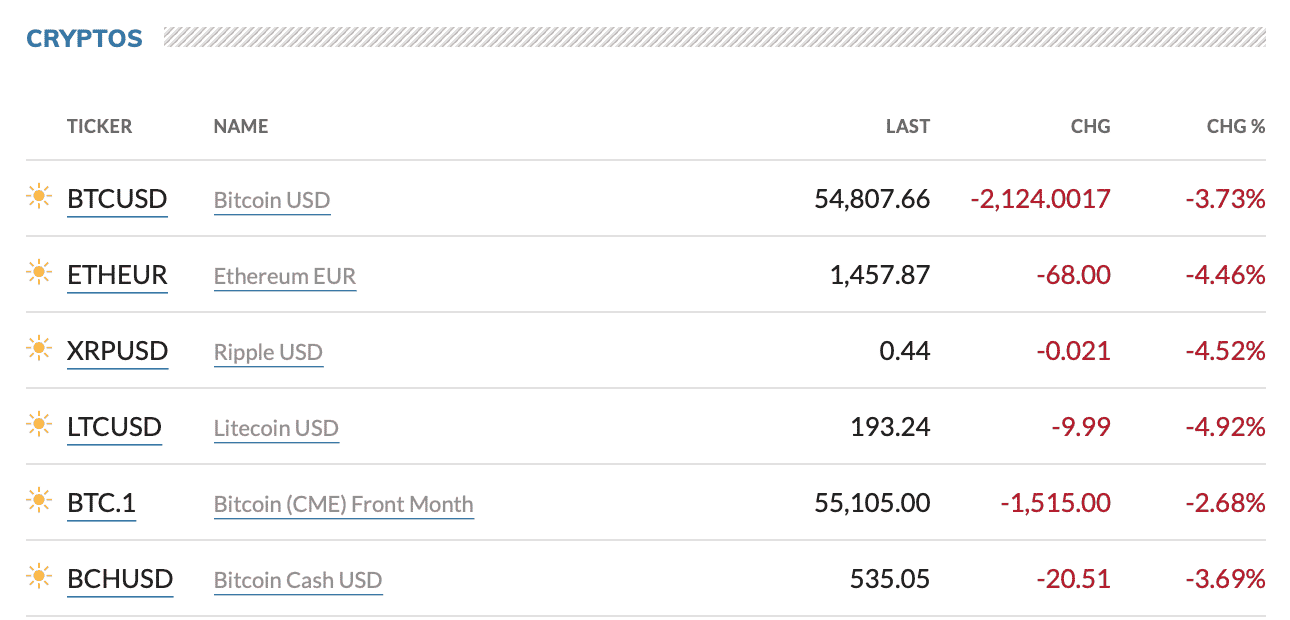

Exchanging one crypto for another The exchange of one cryptocurrency for another causes taxable gain. The eligibility for this 0 tax rate depends on your filing status annual income you make and how long you kept the cryptocurrency before selling it.

The Most Crypto Friendly Tax Countries Wanderers Wealth

The Internal Revenue Service IRS treats all cryptocurrency as capital assets and taxes them when theyre sold at a profit.

Selling cryptocurrency taxes. This includes sales or exchanges for fiat goods services or other cryptocurrencies. The following chart shows you a summary of these three variables and how you can qualify for the zero percent crypto tax rate. Any reference to cryptocurrency in this guidance refers to Bitcoin or other crypto or digital currencies that have similar characteristics as Bitcoin.

The taxable amount for VAT purposes will be the Euro value of the cryptocurrency at the time of the supply. If and when you sell your cryptocurrency you will owe capital gains taxes on any profit. Buying crypto donating coin swaps.

Taxable crypto events. If you bought 10000 in Bitcoin and sold it for 13000 for example your taxable gain would be 3000. Making a stablecoin trade Trading a cryptocurrency for a stablecoin is a taxable event.

Trading and exchanging crypto Trading one cryptocurrency for another is a taxable event. That means that when you purchase goods or services with cryptocurrency. If you owned your crypto for less than 12 months the taxes you pay will be the same as your normal income tax rate.

Selling crypto Tax is applied when you sell crypto for a profit and will either be a short or long term tax rate. 23 Mining Income received from cryptocurrency mining activities will generally be outside the scope of. The most important thing to understand about the tax implications of cryptocurrency is that the IRS has designated all virtual currency as a form of property.

0 Long-term crypto capital gain tax threshold. Through the eyes of the IRS cryptocurrency is viewed as a capital asset when sold for profit and subject to capital gains tax. Selling crypto for fiat currency is a taxable event.

How Do Cryptocurrency Taxes Work. In this example Emma incurs a 200 capital loss 1000 - 1200. These vary depending on.

As a result tax rules that apply to property but not real estate tax rules transactions like selling collectible coins or vintage cars that can appreciate in value also apply to bitcoin ethereum and other cryptocurrencies. If you sell or spend your crypto at a loss you dont owe any taxes on the transaction. In most countries where crypto is taxed three types of tax rules apply.

Crypto mining staking hard forks and interest income. This loss gets deducted and actually reduces Emmas taxable income. Lets look at an.

If you sold your crypto for. If you hold the crypto for more than a year then your cryptocurrency tax rate is the lower capital gains rate which changes depending on your federal income tax. How the IRS Treats Cryptocurrency.

In general if you sell or exchange your cryptocurrency it is a taxable event. When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax. If you are involved in acquiring or disposing of cryptocurrency you need to be aware of the tax consequences.

For many countries including the USA Canada Australia and parts of Europe cryptocurrency transactions are uniquely subject to capital gains tax and the onerous reporting requirements that come. You pay Capital Gains Tax when your gains from selling. If you held the asset for less than one year your cryptocurrency gains will be taxed as a short-term capital gain at the same rate as your ordinary income with a range of 10 37.

If you hold crypto for a year or less before selling it your cryptocurrency tax rate is that of short-term gains which is taxed at your income tax rate. Selling crypto swapping crypto. Buying and selling crypto is taxable because the IRS identifies crypto as property not currency.

For example if you bought 50000 of Bitcoin. In the United States crypto exchanges must report user activity on gains and losses to the Internal Revenue Service IRS and cryptocurrency is taxed in. VAT is due in the normal way from suppliers of any goods or services sold in exchange for bitcoin or other similar cryptocurrencies.

So for tax purposes your bitcoin is more like a stock.

Taxes On Cryptocurrencies Like Bitcoin In The Czech Republic Medium

Germany Cryptocurrency Tax Guide 2021 Koinly

A Complete 2020 Guide To Cryptocurrency Taxes Taxbit

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Cryptocurrency Taxation How To Take A Step Forward Inter American Center Of Tax Administrations

How To Report Cryptocurrency On Taxes Tokentax

Uk Cryptocurrency Tax Guide Cointracker

Australian Cryptocurrency Tax Guide 2021 Koinly

Cryptocurrency Taxes In The Uk The 2021 Guide Koinly

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

Tax On Cryptocurrency In Spain The Best Place In Eu 2021

Uk Cryptocurrency Tax Guide Cointracker

Income Tax Implications Of Transactions In Crypto Currency

Taxes On Cryptocurrency In Spain How Much When How To Pay

How Is Cryptocurrency Taxed Forbes Advisor

6 Ways To Minimise Cgt On Cryptocurrency Uk Cryptocurrency Accountant And Tax Advisers Cryptocurrency Tax Specialist

![]()

Cointracking Crypto Tax Calculator

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker